- 27 Feb 2024

- 5 min read

- By Claire Ryan

Sunshine State property prices show no signs of slowing down

Another quarter has brought another round of records for Queensland’s property prices, according to the latest quarterly median sales results (December 2023 Quarter) released by the Real Estate Institute of Queensland (REIQ) today.

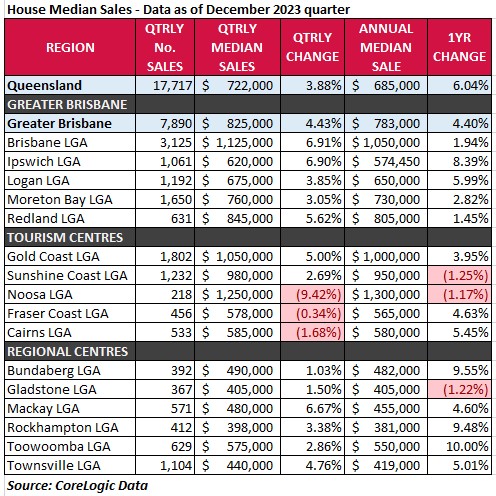

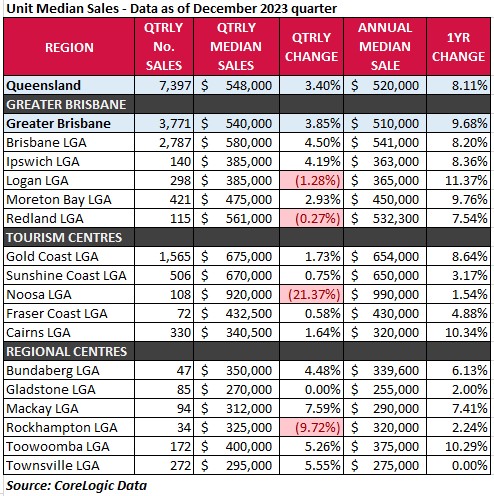

Across Queensland, median house prices climbed 3.88 per cent over the quarter, and 6.04 per cent over the year, and this healthy growth was also reflected in the unit market with the state median median rising 3.4 per cent over the quarter or 8.11 per cent annually.

The capital city led the charge for house price growth over the quarter at 6.91 per cent to a Brisbane LGA median of $1,125,000, with this growth rate matched by neighbouring city Ipswich but at a relative bargain median price of $620,000.

Previously only a position held by Brisbane and Noosa, the Gold Coast got a podium place for hitting the million-dollar median mark this quarter, after rising an impressive five per cent.

Taking a broader view, Queensland’s regional housing markets also continued to experience strong growth, with Toowoomba, Rockhampton, Bundaberg, and Townsville all standout performers over the year and nudging closer to brand-new price brackets.

REIQ CEO Antonia Mercorella said another quarter of solid performance proved the price growth experienced in Queensland was sustainable and likely to stay firm.

“Property prices in the Sunshine State have continued to steadily track in a northerly direction in the December 2023 quarter, rounding out another impressive growth year,” Ms Mercorella said.

“While these sale prices are cause for celebration for property owners when it comes time to sell, it can be frustrating and disheartening for buyers trying to enter or transition into the market.

“This is particularly true for first home buyers who are competing with other prospective and established buyers for value buys and deals that aren’t as good as they once were.

“The reality is that a balanced marketplace could support both – we want to see the dream of home ownership stay alive for first home buyers in our state, and we need property investors to put a roof over the head of our renters.

“However, we’re still in a position where the shortage of supply is driving the market and we’re lacking the housing diversity we need for everyone in our community - the critical gap of course is at the affordable end of the market.

“For listings that address this gap, real estate agents are reporting that the open homes are overflowing, and second open homes are often unnecessary.

“In lifestyle locations like the Gold Coast, that just surpassed a $1 million house median, most of the stock coming to market is set to cater to luxury living, further perpetuating a high-end, high median market.

“There’s been low levels of construction over a long period of time, lagging social housing builds, and add to that accelerated migration to Queensland, and you’ve got a recipe for a housing crisis.

“Regionally, our most affordable markets are still nudging into never-before-seen territory, with Rockhampton’s housing market for example, poised to tip over $400,000.

“The regions still offer exceptional value and affordability, and it’s exciting to see these economies having their time in the sun, riding the strength of their property markets.”

Houses data

House market highlights

The highest volume of house sales across the quarter were Brisbane (3,125), Gold Coast (1,802) and Moreton Bay (1,650). Regionally, Townsville took the cake with 1,104 sales.

At a quarterly median of just over $1 million, the Gold Coast joined Brisbane ($1.125 million) and Noosa ($1.25m) in the million-dollar median club for the first time.

The strongest house markets for quarterly growth were Brisbane (6.91%), Ipswich (6.9%) and Mackay (6.67%). Redland (5.62%), the Gold Coast (5%) and Townsville (4.76%) were not far behind, all achieving growth higher than the state average.

Fraser Coast (-0.34%) remained stable, alongside Cairns (-1.68%) with potential impacts from Cyclone Jasper in December yet to flow through to the Cairns market.

Noosa – a highly unique lifestyle playground with a median higher than the capital city - dropped 9.42% over the quarter, not necessarily a cause for alarm, but simply suggesting the sales this quarter were no match for the phenomenal period that preceded it.

Looking at annual growth, the standouts were in regional Queensland with Toowoomba holding double digit growth at 10 per cent, following by Bundaberg (9.55%) and Rockhampton (9.48%). Again, Ipswich was among the top performers with 8.39% annual growth.

The longest annual median days on market were seen in Noosa (52 days), Fraser Coast (40 days), Sunshine Coast (37 days), and Gladstone (36.5 days). The fastest moving markets were Ipswich and Toowoomba (both at 18 days), closely followed by Bundaberg, Cairns and Logan at 20 days and Rockhampton and Townsville at 21 days. The average house sales campaign length in Queensland was 25 days, and Brisbane’s was 23 days.

Units data

Unit market highlights

Over the quarter, the highest unit sales volumes were seen in Brisbane (2,787 sales) and the Gold Coast (1,565 sales) both recording positive quarterly growth and even better annual performance at over eight per cent. The regions topped the state in terms of quarterly unit growth, with Mackay achieving 7.59 per cent growth based on 94 sales, and Townsville (5.26%) and Toowoomba (5.26%) not far behind. Unit markets that remained relatively stable this quarter were Logan, Redland, Fraser Coast, Sunshine Coast and Gladstone, while Rockhampton took a step back (-9.72%) but based off just 34 sales. Again, Noosa showed a much greater discrepancy from the previous quarter (-21.37%) but importantly maintained a positive annual growth trajectory and reflects the variety of properties coming up for sale from quarter to quarter in this tightly held enclave. Double-digital annual growth in the unit market was seen in Logan (11.37%), Cairns (10.34%), and Toowoomba (10.29%). Moreton Bay (9.76%), Gold Coast (8.64%), and Ipswich (8.36%) followed, again demonstrating the strength of these property markets. The longest lengths of time to contract for unit sales over the past 12 months were seen in Gladstone (53 days), Noosa (52 days), and Townsville (39 days). The relative affordability of units has seen them being snapped up incredibly quickly. Units in Logan weren’t on the market for long with just 15 days to sign on the line, with Bundaberg and Toowoomba taking 17 days and Brisbane and Cairns at 18 days. The state average for unit sales campaign length reached 22 days. Notes to Editors: Media enquiries: ENDS Read another media release from the REIQ: The 'How' is missing from Housing Plan says REIQ. Or browse our suite of media releases here.

Claire Ryan, Media and Stakeholder Relations Manager, The Real Estate Institute of Queensland

M: 0417 623 723 E: media@reiq.com.au

You might also like

View All Articles

View All Articles

Start your Real Estate Career

Need help? 1300 697 347 or contact us