- 02 Jul 2025

- 3 min read

- By Claire Ryan

Real estate is the hero of the Queensland Budget

Queensland real estate is making a significant contribution to the State Budget, even more so than mining, according to the REIQ’s analysis of the forward estimate figures in the budget handed down last week.

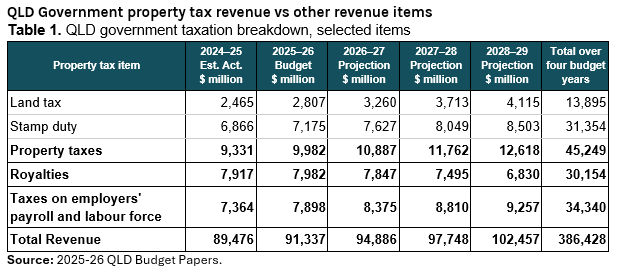

The Queensland Budget revealed property taxes will average $11.3 billion annually and contribute $45.2 billion to the Queensland Budget over the next four years (2025-26 to 2028-29). This includes $31.4 billion in stamp duty and $13.9 billion in land tax.

This compares to $30.2 billion in royalties over four years – a $15 billion difference.

Property tax revenue is also growing faster than all other revenue sources (except for motor vehicle registration), at more than twice the rate of total government revenue. That is, 35.2% growth for property taxes, compared with 14.5% growth of total revenue over the four-year period.

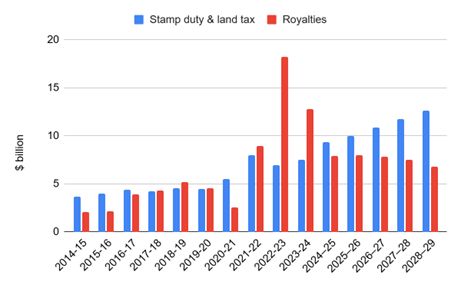

REIQ CEO Antonia Mercorella said Queensland real estate was the largest contributor of any sector to the budget bottom line, and by 2028-29 stamp duty and land tax will outpace royalties by a record margin.

“Real estate is the backbone of the local economy, as one of the largest employers in Queensland of around 49,500 people and providing the state’s largest revenue source,” Ms Mercorella said. [1]

“Over the next four years, property tax revenue will contribute around $1 in every $9 to Queensland general government revenue.

“While royalties have previously spiked on the back of global coal prices, property taxes have now taken top place as Queensland’s largest and growing revenue stream.

“Property tax revenue exceeds mining royalty revenue by a significant margin, with $45.2 billion in property taxes compared with $30.2 billion in royalties over the next four financial years.

“In 2028-29, the gap between property taxes and royalties is projected to be the widest on record - with stamp duty and land tax set to exceed royalty revenue by $5.8 billion.

“It marks a significant shift in Queensland’s revenue base, with property now firmly overtaking resources as the dominant contributor.”

Ms Mercorella said Queensland was becoming over reliant on these taxes to fund essential jobs and services for Queensland.

“In 2025-26, the property tax takings could equate to 30,311 full-time equivalent (FTE) state public servants including nurses, teachers, police officers and more,” she said.

“To break this down, property tax revenue represents the equivalent of 13,053 FTE public servants in Queensland Health, 8,541 employees in Education Queensland, 2,163 employees in the Queensland Police Service, and 6,554 in other agencies.[2]

“Given the significance of our industry – not only as an incredible boon to the budget, but also as the business sector that helps put a roof over the heads of Queenslanders – we will continue advocating for conditions and policy settings that support a sustainable industry.

“A strong, stable and sustainable real estate sector benefits all Queenslanders.”

The total value of all residential real estate in Queensland was $2.15 trillion in March, according to the ABS.[3] Over the last five years (since March 2020), the value has approximately doubled, increasing by 96% from around $1.10 trillion.

Property taxes will increase their share of total taxation revenue from 33.2% in 2023-24 to 39.2% in 2028-29, and total general government revenue from 8.4% in 2023-24 to 12.3% in 2028-29.

Ms Mercorella said the REIQ would like to see future adjustments in property taxes as the state’s budgetary position improves in the coming years.

“The substantial increase to property tax revenue is due to escalating property prices pushing properties into higher tax brackets - it’s a case of serious bracket creep,” she said.

“While the state economy has been the beneficiary of this eye-watering revenue, it’s also important to recognise its fiscal impact on property owners and damping effect it can have on investment and market participation.

“The REIQ believes it’s time to address bracket creep, but ultimately, there needs to be a comprehensive reform of stamp duty.

“With property prices rising, the burden of stamp duty is higher than ever.

“Stamp duty is a regressive tax that adds significant upfront costs to property transactions, thereby dissuading turnover and mobility, and creating housing market inefficiencies by delaying downsizing for empty nesters and upsizing for young families.

“We appreciate that stamp duty is worth $31.4 billion over the Budget forwards, so we would welcome a phased-out approach to avoid placing additional pressure on the state’s finances.”

Queensland Government property tax versus royalties

Source: ABS (Taxation Revenue, Australia, Government Finance Statistics and QLD Budget 2025-26).

ENDS

Media enquiries:

Claire Ryan, Media and Stakeholder Relations Manager, The Real Estate Institute of Queensland

M: 0417 623 723 E: media@reiq.com.au

Read another media release from the REIQ: Budget delivers on support for aspiring first home buyers.

Or browse our media releases.

[1] 49,500 real estate professionals were licenced as of October 2024 (including around 2,000 auctioneers). The precise numbers are 49,477 total real estate professionals, including 47,494 real estate agents and 1,983 auctioneers. https://www.data.qld.gov.au/dataset/occupational-and-industry-licensing-statistics-office-of-fair-trading/resource/f9065c8b-2c9c-4ada-95ec-61319aeed76c

[2] Estimated by applying property tax’s share of total government revenue in 2025-26 to estimates of Queensland FTE public servants by agency reported in Queensland Budget Paper no. 2, Table 4.2, p. 75.

You might also like

View All Articles

View All Articles

Start your Real Estate Career

Need help? 1300 697 347 or contact us