- 30 Nov 2023

- 6 min read

- By Claire Ryan

Queensland property stays in good shape

Trim listings, taut supply and terrific lifestyle – the latest median sales results released by the Real Estate Institute of Queensland (REIQ) today, shows property across the Sunshine State stayed in good shape over the September 2023 quarter (July – September 2023).

Statewide price movements crept up steadily with median house prices lifting by 2.07 per cent over the quarter to a median of $690,000, and median unit prices rising by 3.92 per cent to a median of $530,000.

REIQ CEO Antonia Mercorella said Queensland property was undeniably a good, consistent performer, and continued to be an alluring and reliable ‘bricks and mortar’ buy.

“Unit price growth seems to be awakening from a long slumber, as people adjust their expectations and use them as stepping stones into the housing market,” she said.

“It’s not surprising that units are gaining popularity due to their relatively affordable price point, when budget conscious buyers are wary of rising interest rates and cost of living.

“When once upon a time you could find more affordable freestanding houses to buy around the half-a-million dollar-mark with a reasonable commute to the city, we’re now hearing that first home buyers are turning to apartments and units instead.

“For instance, Greater Brisbane’s unit market continues to go from strength to strength representing great value and growth in good proximity the state capital.

“Logan’s unit market in particular was a standout with 9.17 per cent growth over the quarter, and a solid 11.11 per cent growth over the year to $350,000.”

Ms Mercorella said that interest in regional Queensland’s housing market was rising as a relatively affordable choice and, in most cases, with attractive annual growth.

“Those seeking value for money are finding it in our regional economic powerhouses - Toowoomba and Townsville,” she said.

“You’re looking at an annual median house price of $530,000 in Toowoomba and just over $400,000 in Townsville – well below Greater Brisbane’s $760,500 median price point.”

She said that the shortage of sales listings had become somewhat of a catch 22 situation in the Sunshine State.

“The biggest challenge at the moment is people’s reluctance to sell and make the jump to their next property,” Ms Mercorella said.

“Real estate agents are telling us that people do want to sell their properties, but they’re also held back by concerns about what they are going to be able to buy back into in such a tight market - so it’s a frustrating situation for so many.”

Ms Mercorella acknowledged there had been a few small dips over the quarter, as well as some prices retreating slightly when comparing year to year, but it was important to remember we were coming off record-setting highs.

“It’s not really comparing apples with apples when trying to draw parallels with a particularly remarkable period of time in real estate,” she said.

“We are back to a consistent, ‘steady as she goes’ market which means there will be some expectation management needed for both sellers and buyers.

“On one hand, sellers may need to temper their expectations somewhat from the crazy highs, but equally, buyers who had hoped a bargain was just around the corner will be sorely disappointed as the shortage of stock is keeping the competition hot.

“Interstate migration and a tight job market are helping to underpin the housing market.

“Queensland property has shaped up to its age-old reputation as a consistent, reliable player, and we expect to see more of the same steady growth as we bring in the new year.”

House market highlights

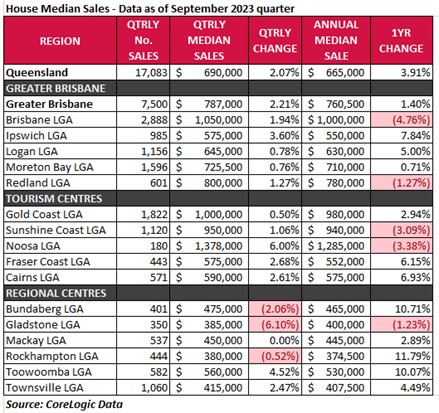

The highest volume of house sales across the quarter were Brisbane (2,888), Gold Coast (1,822), and Moreton Bay (1,596), followed closely by Logan (1,156), Sunshine Coast (1,120) and Townsville (1,060).

Reminiscent of Sydney suburb prices, Noosa again held the top gong for the most expensive housing market in Queensland with a whopping $1.378m median this quarter.

Other seven figure medians were seen in Brisbane LGA ($1.05m) and Gold Coast ($1m), with the Sunshine Coast in striking distance at $950,000.

Rockhampton ($380K) and Gladstone ($385K) landed themselves at the other end of the affordability scale. Ipswich ($575K) represented best bang for buck in Greater Brisbane.

The strongest house market performers for quarterly growth were Noosa (6%), Toowoomba (4.52%) and Ipswich (3.60%) – arguably representing the best of Queensland’s lifestyle, regions, and city outskirts. Above average quarterly growth was also seen in Fraser Coast (2.68%), Cairns (2.61%) and Townsville (2.47%).

Conversely, Mackay, Rockhampton, and Gold Coast’s housing markets barely waivered over the quarter, while Bundaberg retreated slightly (-2.06%). Gladstone experienced a more substantial dip over the quarter, based on 350 sales, which may be more of a reflection of the type of stock coming to market.

Looking at annual growth, the regions really shone with double digit growth revealed in Rockhampton (11.79%), Bundaberg (10.71%), and Toowoomba (10.07%). Townsville also had a strong 4.49% uptick year on year.

In the tourism centres, Fraser Coast (6.15%) and Cairns (6.93%) also recorded impressive annual growth. Meanwhile, in the south east corner the standouts were Ipswich (7.84%) and Logan (5%).

Those housing markets which showed a material decrease in sales price when comparing year on year are simply course corrections after reaching staggering heights a year ago. These included Brisbane (-4.76%), Sunshine Coast (-3.09%) and Noosa (-3.38%).

The statewide median days on market remained fairly consistent at 28 – a snappy four-week campaign. The longest days on market were clocked up in Noosa (59 days), Gladstone (42 days), Sunshine Coast (39 days), and Fraser Coast (37 days). While the fastest moving markets from listing to signing on the line were Toowoomba (18 days), Ipswich (19 days), Logan and Townsville (both 24 days).

Unit market highlights

The uptick in unit price growth over the quarter virtually across the state was an interesting sign of shifting focus, as buyers switched gears to pursue affordable options.

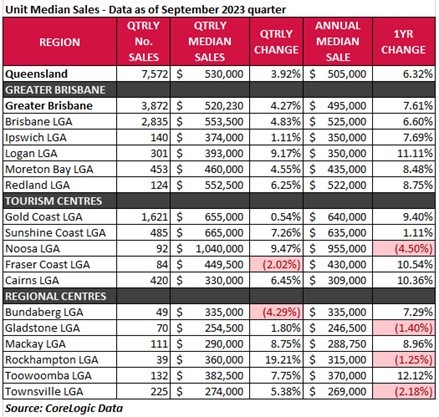

Brisbane (2,835) and the Gold Coast (1,621) continue to top the number of quarterly sales for units, with Sunshine Coast (485) and Moreton Bay (453) coming in a distant third and fourth place.

It seems virtually impossible to knock Noosa off the podium for the most expensive unit market in Queensland with a median unit price of $1,040,000 this quarter, absolutely streets ahead of the broader Sunshine Coast ($665K) and Gold Coast ($655K) – keeping in mind that the sales volumes may skew the median in the favour of tightly-held Noosa.

Most affordable unit market for the quarter went to Gladstone at $254,500, closely followed by Mackay at $290,000. Cairns and Bundaberg units represented exceptional value at $330,000 and $335,000 respectively. In the south east corner, Ipswich ($374K) and Logan ($393K) were again where to buy a unit to make your dollar go further, albeit further out from the city.

In terms of quarterly growth performance, the Rockhampton unit market blew out at 19.21 per cent – however, this is to be taken with a grain of salt given its based on just 39 listings. Noosa also had an impressive 9.47 per cent growth based on 92 sales.

Other notable unit market performers over the quarter were Logan (9.17%), Mackay (8.75%), Toowoomba (7.75%), and the Sunshine Coast (7.26%).

Unit markets which receded this quarter were only a blip compared to their strong annual growth – including Fraser Coast (-2.02% for the quarter, but up 10.54% over the year), and Bundaberg (-4.29% quarter on quarter, but still a strong 7.29% year to year).

Turning now to annual growth – Toowoomba (12.12%) and Logan (11.11%) unit markets stole the show, while the runners up, Fraser Coast (10.54%) and Cairns (10.36%), also managed double-digit growth.

Units in Queensland sold on average in as little as three weeks, but buyers really had to get their skates on in Bundaberg (16 days), Logan (17 days) and the Redlands (19 days).

Notes to Editors:

- Insights derived by the Real Estate Institute of Queensland based on CoreLogic Data.

- A median sale price is derived by arranging a set of sale prices from lowest to highest and the selecting the middle value within this set (i.e. the 50th percentile, where half of recorded sales were less and half were higher than the median).

- Only suburbs and regions to record sufficient sales numbers (at least 10 sales for the quarter) at the time of reporting are considered statistically significant.

- Days on market is calculated as the median number of days it has taken to sell properties (from first advertised date to contract date) by private treaty during the last 12 months (excludes auction listings and listings where an asking price is not advertised).

Media enquiries:

Claire Ryan, Media and Stakeholder Relations Manager, The Real Estate Institute of Queensland

M: 0417 623 723 E: media@reiq.com.au

Houses data

Units data

Read more from the REIQ: Queenslands top real estate professionals have their day in the sun.

Or browse our suite of media releases.

You might also like

View All Articles

View All Articles

Start your Real Estate Career

Need help? 1300 697 347 or contact us