- 27 Nov 2024

- 4 min read

- By Claire Ryan

Queensland real estate steadies, but set to 'Spring'

Queensland’s rapidly rising residential property prices stabilised over the September 2024 quarter (July – September 2024), as a wave of Spring sales began settling.

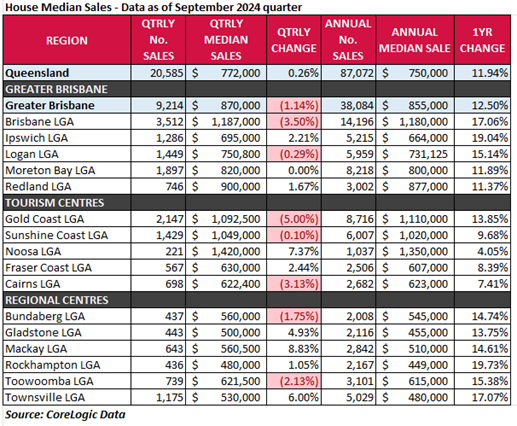

The latest median sales results released by the Real Estate Institute of Queensland (REIQ) today, reveals a modest 0.26% increase in Queensland’s median house prices for the quarter, lifting to $772,000.

While annual house price growth remains impressive across the state, some regions saw slight quarter-on-quarter dips, suggesting a slowdown rather than a halt in price growth.

The Gold Coast, Brisbane, and Cairns were among the house markets showing signs of stabilisation, while regional areas like Mackay (8.83%), Noosa (7.37%), Townsville (6%) and Gladstone (4.93%) experienced the most significant quarterly gains.

Noosa held onto the crown for Queensland’s most expensive market, with a remarkable quarterly median house price of $1.42 million, surpassing Brisbane ($1.187m), the Gold Coast ($1.092m) and the Sunshine Coast ($1.049m), which also posted million-dollar-medians.

In Greater Brisbane ($870K), prices continued their steady ascent, with Redlands reaching a median of $900,000, Moreton Bay at $820,000, and Ipswich maintaining its reputation for value for money at $695,000.

For prospective buyers chasing a quarterly house median sales price under the half million mark, opportunities have become increasingly limited, and Rockhampton ($480K) and Gladstone ($500K) are the last remaining regional centres under this milestone.

Median days on market continue to drop, with Queensland houses now selling in 21 days. The longest annual median days on market were Bundaberg (47 days), Moreton Bay (38) and Rockhampton (29). The fastest were Townsville (13), Mackay (13), Fraser Coast (14.5).

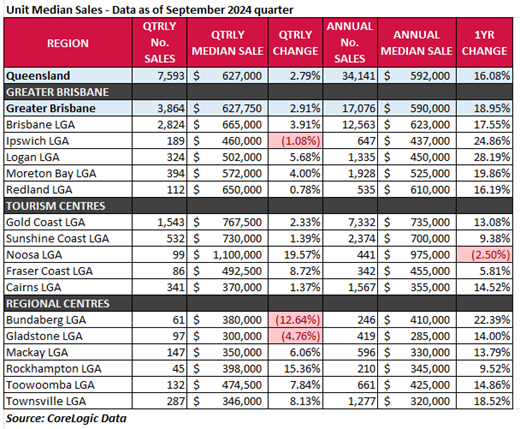

Meanwhile, units continue to perform strongly while remaining comparatively much more affordable, rising 2.79% over the quarter across Queensland to $627,000.

Staggering annual unit median price growth as high as 28.19% in Logan, 24.85% in Ipswich, and 22.39% in Bundaberg demonstrates a steep rise in popularity.

Quarterly standout unit market performers were Noosa (19.57%) and Rockhampton (15.36%), and solid growth was also seen in Fraser Coast (8.72%) and Townsville (8.13%).

Bundaberg took a backseat for price growth over the September quarter but is still underscored by impressive annual growth. Similarly, Ipswich and Gladstone had smaller dips quarter-to-quarter, but off the back of sizeable annual changes.

Noosa units are in a league of their own when it comes to prices, sitting at a staggering $1.1 million in the September quarter, smashing the rest of the state’s unit prices, as well as eclipsing many housing markets. Second and third most expensive unit markets go to the Gold Coast ($767K) and Sunshine Coast ($730K), with Brisbane missing out on the podium finish at $665K.

The Gladstone unit median was the most affordable at $300K, followed by Townsville ($346K), Mackay ($350K), and Cairns ($370K). Closer to Brisbane, Ipswich sits at $460K.

Queensland units are now selling in a rapid 18 days. The longest annual days on market for units were in Bundaberg (45 days), Townsville and Fraser Coast (both 29 days). The fastest were ties between Sunshine Coast, Noosa and Cairns (all 13 days), and Brisbane and Toowoomba (both 14 days).

REIQ CEO Antonia Mercorella said while prices may not be soaring as high as they have in recent years, the steady market reflects sustained demand and resilience in the state.

“The September quarter results demonstrate a stabilisation in Queensland's residential property market, which is a positive sign of the market finding its rhythm after a period of rapid price escalation,” Ms Mercorella said.

“Holiday markets are more impacted by seasonality and may be yet to see the fruits of the Spring selling season translate into settlement prices.

“Despite the slight quarterly fluctuations in some areas, the annual figures confirm Queensland’s property market remains a solid investment choice, with diverse opportunities from lifestyle coastal communities to affordable regional centres, to the most exciting metropolitan market in the country.

“More immune to buyers’ budgets, units continue to grow in appeal for both investors and owner-occupiers, providing a compelling alternative for those seeking affordability without compromising on lifestyle or location.”

Ms Mercorella said despite rising prices, encouragingly, first home buyer activity has also remained steady, with 22,500 new loans over the past 12 months, representing 19% of the market.

“The average loan size for first home buyers has increased to $535,000, up 13 per cent over the past 12 months and 50 per cent since pre-COVID levels.

“A deposit of that size suggests a median purchase price of around $670,000 for first home buyers – a striking figure given that all median prices across Greater Brisbane exceeded this level during the September quarter.

“We are yet to see the full impact of the revised stamp duty concession threshold for first-home buyers, but we anticipate it will provide some much-needed relief in this challenging market.

“With all the recent speculation about interest rate cuts, buyers may be waiting to see what happens, hoping to boost their buying power.”

Ms Mercorella said supply constraints were the biggest stranglehold on the housing market, compounded by the high cost to build in Queensland.

“Recent ABS data that showed that Queensland recorded the largest increase in the cost of building houses over the past five years - up 44%. At an average cost of $450,612, it is now the second most expensive state for building new homes,” she said.

“Building approvals have risen for the first time in nearly three years with 34,800 dwellings approved over the 12 months to September – however, this is still a long way off target and what is needed to address demand.

“Most of this growth in approvals came from units, which continue to see strong demand and represent an essential part of addressing Queensland’s housing needs.”

Houses

Units

Days on market

Notes to Editors:

- Insights derived by the Real Estate Institute of Queensland based on CoreLogic Data.

- A median sale price is derived by arranging a set of sale prices from lowest to highest and the selecting the middle value within this set (i.e. the 50th percentile, where half of recorded sales were less and half were higher than the median).

- Only suburbs and regions to record sufficient sales numbers (at least 10 sales for the quarter) at the time of reporting are considered statistically significant.

- Days on market is calculated as the median number of days it has taken to sell properties (from first advertised date to contract date) by private treaty during the last 12 months (excludes auction listings and listings where an asking price is not advertised).

ENDS

Media enquiries:

Claire Ryan, Media and Stakeholder Relations Manager, The Real Estate Institute of Queensland

M: 0417 623 723 E: media@reiq.com.au

Read another media release from the REIQ: REIQ takes property management training to Papua New Guinea.

Or browse our suite of media releases.

You might also like

View All Articles

View All Articles

Start your Real Estate Career

Need help? 1300 697 347 or contact us