- 02 Mar 2025

- 3 min read

- By Claire Ryan

Queensland property continues to inspire confidence

Queensland’s property kept powering ahead over the December 2024 quarter, according to the latest median sales results released by the Real Estate Institute of Queensland (REIQ).

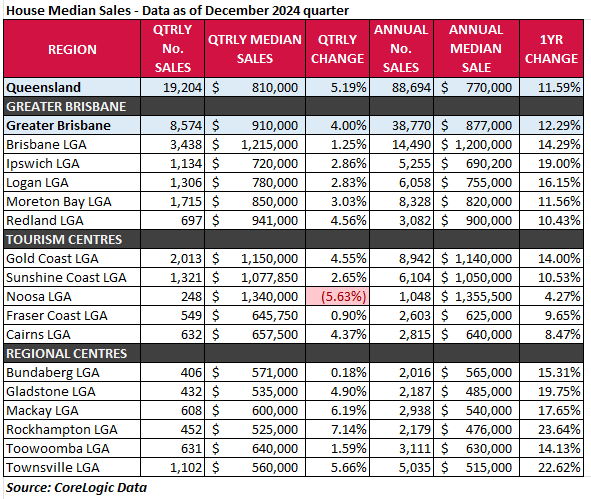

Over the quarter, the median sale price for houses across Queensland rose a phenomenal 5.9% to $810,000 - a quarterly uplift not seen since early 2022 in the post-pandemic surge.

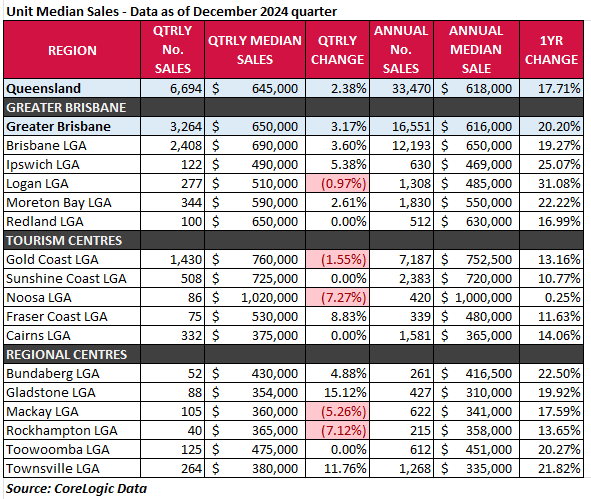

Meanwhile, for units across Queensland, the median sale price grew 2.38% to $645,000 – while still solid growth, this represents a retreat from the significant growth spurts seen in the first two quarters of 2024 (which saw quarterly growth of over 5%).

REIQ CEO Antonia Mercorella said while Brisbane’s median house price crept up by a modest 1.25%, the largest gains were scattered across the sunshine state.

“What is evident from the data is that the growing local economies of areas such as Ipswich, Moreton Bay, Logan, Toowoomba, Townsville, Rockhampton, Gladstone and Mackay, among other regional areas, are sustaining strong housing markets,” she said.

“It also suggests that demand is gravitating towards more affordable housing, as people search for value outside of the capital city, a trend further supported by stronger price growth in Brisbane’s surrounding regions.

“While Brisbane’s ‘Cinderella story’ is far from over, the regions and Greater Brisbane LGAs are proving to be Queensland’s property powerhouses.”

Ms Mercorella said Queensland property had demonstrated unwavering resilience due to strong housing market fundamentals, particularly on the demand side.

“Queensland has consistently strong economic and demographic fundamentals which underpin our state’s property market performance,” Ms Mercorella said.

“Our Gross State Product (GSP) growth of 2.1% outpaced Australia’s Gross Domestic Product (GDP) growth of 1.4% in 2023-24 [1].

“Queensland’s population growth of 2.3% outdid the nation’s 2.1% in the year to last June, particularly our strong net interstate migration of almost 30,000 people[2] - the highest population boost among the states, and more than triple Western Australia’s gains.

“This high net migration as part of our population mix is significant because it’s made up of more adults, compared to more families from natural increase, and this means a higher proportion of people seeking their own households.

“Queensland property prices held firm despite higher for longer interest rates, and we expect they will be invigorated by the recent cash rate cut and associated confidence.”

These fundamentals have not been fleeting either - over the longer term, Queensland has also outperformed the rest of Australia in terms of economic growth and population.

Since 1989-90, Queensland’s GSP has grown at an average annual rate of 3.6% compared with 2.4% in NSW, 2.8% in Victoria, and 2.9% nationwide.1

Over the last 30 years, Queensland’s population has grown at an average annual rate of 1.9% compared with 1.1% in NSW, 1.5% in Victoria, and 1.4% nationwide.2

Ms Mercorella said the REIQ remains concerned that the supply side is lagging behind the demand for properties and maintains that new housing needs to stay a policy priority.

In the September quarter of 2024, private dwelling completions (8,128 dwellings) were below the historical average of 8,500 dwellings between the September quarter of 1984 and the September quarter of 2024.

Moreover, the total number of dwelling completions reached around 32,700, which is well below the required level in Queensland of around 49,000 per annum to meet the national housing target.

House market highlights

The highest volume of house sales across the quarter were Brisbane (3,438), Gold Coast (2,013), Moreton Bay (1,715) and Sunshine Coast (1,321). There was also high turnover compared to population shares in Logan (1,306) and Ipswich (1,134).

The strongest house markets for quarterly growth were Rockhampton (7.14% to $525k), Mackay (6.19% to $600k), Townsville (5.66% to $560k), and Gladstone (4.9% to $535k).

It is perhaps unsurprising to also see that the most affordable markets this quarter were Rockhampton, Gladstone and Townsville.

Townsville stood out as a regional market with a high house sales volume (1,102) and impressive price momentum of 5.66% over the quarter, and 22.62% over the year.

The Gold Coast’s median also climbed an impressive 4.55% to $1.15m, or 14% over the year.

Million-dollar medians were maintained in Noosa ($1.34m), Brisbane ($1.215m), Gold Coast ($1.15m) and Sunshine Coast ($1.077m), while Redland nears at $941k.

However, the niche market of Noosa, is falling into the shadows of its own exponential growth, making it the most expensive market in the state but also the slowest moving - at least temporarily when zeroing in on quarter-to-quarter movements.

In Greater Brisbane, the LGAs of Ipswich (2.86% to $720k), Logan (2.83% to $780k), Moreton Bay (3.03% to $850k) and Redland (4.56% to $941k) all experienced median sales price increases for houses higher than Brisbane LGAs (1.25% to $1.125m), suggesting there could be a search for value and more affordable houses outside of Brisbane.

Looking at annual growth, the vast majority of LGAs posted double-digit growth, with the star performers boasting 23.6% growth in Rockhampton, and 22.62% in Townsville.

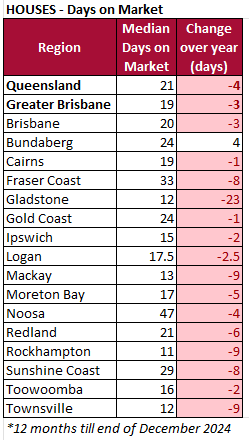

The average sales campaign length in Queensland was 21 days and in Brisbane it was 20 days. Gladstone saw a dramatic drop in average days on market, quickening by 23 days to an average of 12 days on market.

The longest annual median days on market were seen in Noosa (47 days), Fraser Coast (33 days) and Sunshine Coast (29 days). The fastest moving housing markets were yet again, Rockhampton and Townsville.

Houses data

Unit market highlights

Over the quarter, the highest unit sales volumes were seen in Brisbane (2,408) and the Gold Coast (1,430). The Sunshine Coast came in third place with 508 sales and a median unit price that stabilised at $725k this quarter.

Unit data on a quarterly basis can be challenging to interpret because volumes are much lower in regional areas, and figures can be driven by specific significant unit block/tower developments that come onto the market.

However, in saying that, the highest quarterly unit growth was seen in Gladstone (15.12% to $354k), Townsville (11.76% to $380k), and Fraser Coast (8.83% to $530k).

Importantly, annual growth was positive across all Queensland unit markets and was virtually consistent double-digit growth. Logan’s unit market took out the top spot for annual growth at an incredible 31.08%.

However, markets that saw unit sales price stabilisation over the quarter were Cairns ($375k), Redland ($650k), Sunshine Coast ($725k), Toowoomba ($475k), Logan ($510k) and the Gold Coast ($760k).

Mackay ($360k) and Rockhampton ($365k) experienced larger quarterly dips but on small sales volumes, while Noosa teetered on an incredible million-dollar-median for units – continuing to blow the rest of the state out of the water.

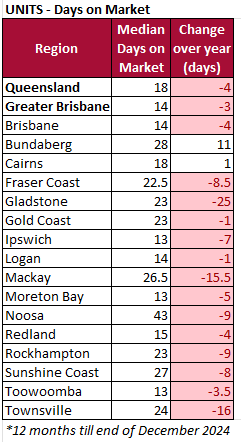

The state average for unit sales campaign length reduced to 18 days. The markets that sped up the most were Gladstone, Townsville and Mackay. The fastest however, was a three-way tie between Ipswich, Moreton Bay and Toowoomba – all 13 days.

Units data

Days on market

Notes to Editors:

- Insights derived by the Real Estate Institute of Queensland based on CoreLogic Data.

- A median sale price is derived by arranging a set of sale prices from lowest to highest and the selecting the middle value within this set (i.e. the 50th percentile, where half of recorded sales were less and half were higher than the median).

- Only suburbs and regions to record sufficient sales numbers (at least 10 sales for the quarter) at the time of reporting are considered statistically significant.

- Days on market is calculated as the median number of days it has taken to sell properties (from first advertised date to contract date) by private treaty during the last 12 months (excludes auction listings and listings where an asking price is not advertised).

ENDS

Media enquiries:

Claire Ryan, Media and Stakeholder Relations Manager, The Real Estate Institute of Queensland

M: 0417 623 723 E: media@reiq.com.au

Read another media release from the REIQ: REIQ backs reform to help student debt holders secure home loans.

Or browse our suite of media releases.

You might also like

View All Articles

View All Articles

Start your Real Estate Career

Need help? 1300 697 347 or contact us