- 25 Nov 2025

- 4 min read

- By Claire Ryan

Housing supply shortage is costing Queenslanders, says REIQ

The Real Estate Institute of Queensland’s (REIQ) latest median sales data for the September 2025 quarter (July – September 2025), lays bare that insufficient housing supply continues to cost Queensland home buyers, putting sustained upward pressure on property prices across the state.

Queensland’s housing market continues to surge with no dips recorded at either the quarterly or annual level – the statewide median house price rose 4.83% over the quarter to $895,000 and is now 12.67% higher than a year ago. Units also performed strongly, with the quarterly median rising 3.57% to $725,000 and annual growth reaching 15.22%.

REIQ CEO Antonia Mercorella said the results highlight the mounting cost of Queensland’s housing shortage and the mounting pressure on those trying to enter the market.

“Across every corner of the state, prices are climbing in a concerning but classic supply story – when demand outstrips new housing delivery, prices inevitably move higher,” she said.

“The data shows that regional Queensland is driving some of the most dramatic price movements, while Greater Brisbane and its surrounding LGAs remain solid but less explosive.

“The particularly strong regional gains highlight that both investors and owner-occupiers are looking beyond the southeast corner for relative value and growth.”

The latest ABS lending data reveals a sharp rise in investor activity across Australia, with Queensland playing a significant role in this trend. Investor loans in Queensland increased by 11.9% over the September quarter, with investors now accounting for around two in every five new home loans in the state.

“In a state like Queensland that relies heavily on investors to provide rental properties, it’s important to remember that investor participation is essential to achieve a healthy rental market,” Ms Mercorella said.

“However, unless we see overall housing supply levels improve alongside returning investor confidence, it can lead to the inevitable clash between investors and prospective owner-occupiers – and that is why the real solution must lie in expanding supply.”

Encouragingly, the Federal Government’s expanded First Home Guarantee commenced on 1 October, immediately following this reporting period, and is expected to go some way in tipping the balance back to owner-occupiers. While first home buyer loans in Queensland dipped marginally in the quarter, the change remains within normal volatility levels.

While some are calling for new investor lending rules, Ms Mercorella cautioned that excessive restriction could undermine the rental market and worsen supply shortages.

“The focus should be squarely on unlocking more homes – not constricting one segment of the market. We need a balanced approach that supports both rental supply and pathways to ownership.”

She said the data reinforces the urgency for sustained policy action to increase dwelling construction, increase targeted housing density, and diversify housing options.

“Queensland’s housing market remains remarkably resilient and fiercely competitive, but price growth without sufficient new supply only deepens affordability challenges,” Ms Mercorella said.

“If we want a future where home ownership remains attainable, governments must stay firmly committed to driving new housing delivery and supporting first home buyers.”

House market insights

The Redlands officially become a million-dollar-median house market this quarter ($1.03m), and Noosa surged to a whopping $1.5 million quarterly median. They joined Brisbane ($1.33m), Gold Coast ($1.26m) and the Sunshine Coast ($1.16m). Interestingly, the most affordable and most expensive major markets recorded some of the highest quarterly growth in the state – with Rockhampton (up 7.27% to $590,000) and Noosa (up 7.14% to $1.5m) demonstrating that momentum is not confined to any single price bracket. Fraser Coast LGA rounded out the top three for quarterly growth at 7.06%. On an annual basis, regional Queensland posted exceptional growth. Townsville led the charge with a 23.3% increase, closely followed by Mackay (22.33%), Gladstone (21.85%) and Rockhampton (21.11%). Other notable regional performers include Toowoomba (14.68%) and Bundaberg (12.91%). Across much of Greater Brisbane, house prices also continued their steady climb over the year, led by Ipswich (up 13.6%), Redland (up 11.93%), Logan (up 11.56%), and Moreton Bay (10.63%) reinforcing the outward ripple effect from the capital as buyers search for more attainable options. Brisbane LGA itself increased by 6.77%, compared to the Greater Brisbane region’s 11.11% growth.

Unit market insights

Units are increasingly popular with first-time buyers offering a relatively affordable price point when compared with freestanding homes.

Noosa recorded a dramatic 22.8% quarterly increase in its unit median to $1.15 million, returning it to million-dollar unit market status, rebounding from an equivalent decrease last quarter. Rockhampton also posted a sharp quarterly uplift of 19%, though off a very small volume of sales (32 sales). Bundaberg (9.89%), Townsville (8.86%), and Mackay (7.95%) also had sizeable quarterly lifts.

Fraser Coast held steady with no movement over the quarter, while Toowoomba (1.85%) and Gold Coast (1.85%) had modest growth, highlighting that some markets are moderating after previous strong runs.

On an annual basis, unit growth has been particularly steep, with Rockhampton leading the state at 30%, followed closely by Townsville (25%), Gladstone (24.39%), Ipswich (23.6%) and Fraser Coast (20.61%). Notably, Ipswich and Logan (19.56%) continue to stand out as strong-performing non-regional unit markets.

Noosa, the Gold Coast and the Sunshine Coast all sit above Brisbane’s annual unit median, which speaks to the premium lifestyle value placed on these coastal markets.

While six markets remain below the half-million-dollar mark for annual median unit prices, these options are becoming increasingly scarce as demand continues to intensify. These include Gladstone ($357k), Mackay ($360k), Cairns ($397k), Townsville ($400k), Rockhampton ($455k), and Bundaberg ($457k).

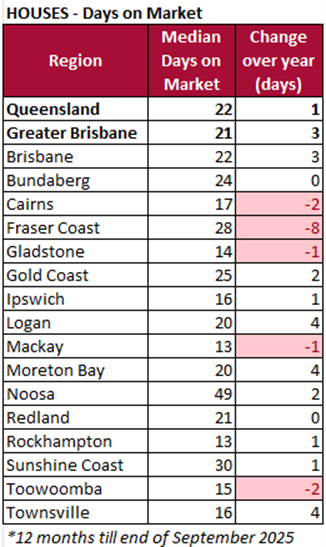

Days on market insights

The pace of sales has remained brisk across most Queensland markets. For houses, the statewide median days on market is 22, up just one day from a year ago, indicating strong buyer activity persists. Brisbane LGA and Greater Brisbane are selling in 22 and 21 days respectively, while regional markets like Mackay and Rockhampton are among the fastest moving at 13 days. Noosa remains the slowest house market at 49 days, reflecting its high-price segment.

Units are moving similarly quickly, with the statewide median days on market at 21, up four days over the year. Brisbane and Greater Brisbane units are selling in just 17 days. Fastest regional markets include Rockhampton (13.5 days) and Toowoomba (13 days), while Noosa units remain slower at 50 days, consistent with its premium price point. Markets like Townsville have shown notable acceleration, dropping 10 days over the year to 18 days on market, highlighting strong regional demand.

Notes to Editors:

- Insights derived by the Real Estate Institute of Queensland based on Cotality Data.

- A median sale price is derived by arranging a set of sale prices from lowest to highest and the selecting the middle value within this set (i.e. the 50th percentile, where half of recorded sales were less and half were higher than the median).

- Only suburbs and regions to record sufficient sales numbers (at least 10 sales for the quarter) at the time of reporting are considered statistically significant.

- Days on market is calculated as the median number of days it has taken to sell properties (from first advertised date to contract date) by private treaty during the last 12 months (excludes auction listings and listings where an asking price is not advertised).

ENDS

Media enquiries:

Claire Ryan, Media and Stakeholder Relations Manager, The Real Estate Institute of Queensland

M: 0417 623 723 E: media@reiq.com.au

Read another media release from the REIQ: Vacancy rate gridlock keeps Queensland at a standstill.

Or browse our media releases.

You might also like

View All Articles

View All Articles

Start your Real Estate Career

Need help? 1300 697 347 or contact us