- 08 Oct 2018

- 8 min read

- By The REIQ

REIQ Stamp Duty Policy Statement

Overview

The Real Estate Institute of Queensland (REIQ) is committed to providing an environment that is conducive to generating economic activity in the real estate sector. Real estate plays an integral role in the Queensland economy, contributing more than $8 billion per annum toward Queensland’s gross state product. With real estate vital to Queensland’s prosperity, it is important that measures are put in place to encourage economic growth and maximise the choices available to consumers.

Accordingly, the REIQ is urging the Government to reform stamp duty. In our view, it is an inefficient and regressive tax that imposes an unnecessary additional cost on property transactions, and discourages turnover of housing. Moreover, it reduces investment in the property market by distorting the choice between moving house and renovating, while also deterring labour mobility for those changing jobs. The abolition of stamp duty would generate increased economic activity and help one of Queensland’s most important sectors grow into the future.

Background

Stamp duty is a tax administered by state and territory governments which applies to transactions whenever property is bought, sold or transferred. It applies to ‘dutiable transactions’ which may include the following:

- signing a contract to buy or sell a home;

- gifting a spouse with a half-share of property;

- granting access across a property (for example, an easement); and

- setting up a trust over land previously owned outright for the benefit of children and/or family members.

Why Stamp Duty needs reforms

Stamp duty charged on the transfer of property is the second-largest source of taxation for state governments, accounting for 24% of state tax revenue1. However, in the REIQ’s view it is also an inefficient tax that stalls economic growth in the real estate sector and makes home ownership less accessible.

As stamp duty is only charged at the point upon which a property transaction takes place, it is a tax that can be easily avoided. People may decide to simply remain in their existing house and invest in renovations rather than purchase a more desirable property, or stay out of the property market altogether.

Indeed, a Deloitte Access Economics report from 2015 estimated that as many as 340,000 property transactions each year are foregone due to the existence of stamp duty2. Moreover, in 2013 Australian economists Ian Davidoff and Andrew Leigh found that a 10% increase in stamp duty leads to a 3% reduction in property transactions in the short-term and a 6% reduction in the long-term3. While Federal Treasury’s Tax White Paper released in 2015, estimated that stamp duty accounts for roughly 45% of the total cost of moving property4.

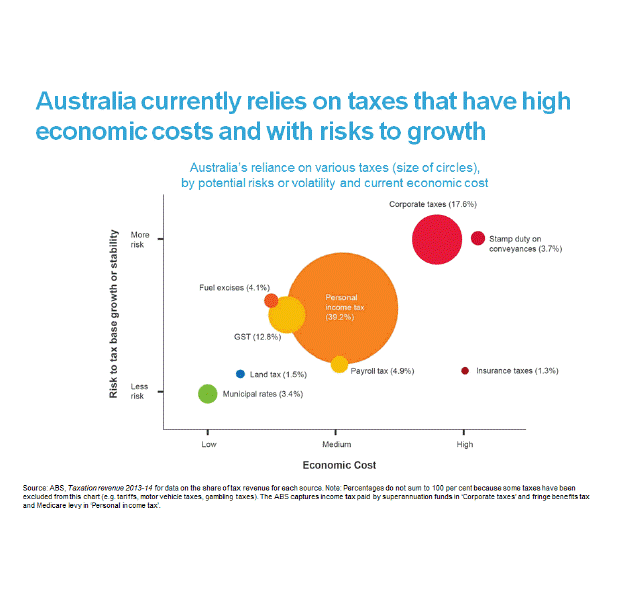

The economic cost of stamp duty was further underlined in a 2015 Treasury presentation provided by Roger Blake entitled An inside perspective on the Tax White Paper. Blake provided detailed analysis demonstrating that stamp duty is the most economically costly and the most volatile of all major Australian taxes5. The below graph from his presentation depicts how stamp duty scores on both these fronts compared to other taxes:

The volatility of stamp duty was also highlighted in the 2009 Henry Tax Review with the below chart demonstrating the fluctuations that occurred in the proportion of overall revenue the tax produced for all state governments between 2000-20096.

The extreme volatility that is inherent within a tax such as stamp duty poses a significant budgetary risk to all state governments, including Queensland. Given that stamp duty only accrues revenue when a property is transferred, the amount of revenue stamp duty generates is directly tied to turnover in the housing market. In the event of an economic downturn, stamp duty collected would fall significantly. This instability in the revenue stream emanating from one of Queensland’s largest sources of taxation would greatly hinder the government’s ability to adequately plan future expenditure. With the Queensland Government already in significant debt and contending the same Vertical Fiscal Imbalance as all other state governments, it cannot afford to continue to be so reliant on a tax that fails to deliver a consistent stream of revenue.

Policy Proposals

The REIQ believes that urgent reform is required to address the detrimental impact this regressive tax has on the property industry. Listed below is a number of policy alternatives relating to stamp duty in order of preference.

Option 1 – Complete Abolition of Stamp Duty & replaced by a land tax

In the first instance, the REIQ advocates abolishing stamp duty in its entirety and replacing it with a tax based on land values. An August 2017 report from the Productivity Commission (PC) formally recommended this reform stating:

“State and Territory Governments should move from stamp duties on residential and commercial properties to a broad-based land tax on the unimproved value of land7.”

Analysis performed by the Treasury in the 2015 discussion paper entitled ‘Re: think’ found stamp duty to be the tax with the highest long-term costs for living standards, while land tax had the lowest economic cost8. This is because land is immobile, however, any capital used to improve the land is not. Hence, stamp duty acts as a disincentive for owners to invest in improving their property with a view to selling it in mutually beneficial transactions.

Moreover, research from the Grattan Institute estimates that replacing stamp duty with a broad-based land tax would add as much as $9 billion annually to GDP across all the states9. A shift from stamp duty to land tax removes the penalty for moving and ensures that the tax burden does not fall disproportionately on certain groups. It would also provide a more stable stream of revenue for state governments, thus addressing the volatility issue that is present within stamp duty.

Abolishing stamp duty and substituting it with a land tax would:

- make purchasing a home more affordable for the average Queenslander;

- provide greater flexibility and choice for aspiring home-owners; and

- would provide the Queensland Government with a more reliable and efficient revenue stream to fund the various services it is responsible for.

Option 2 - Exemptions for older Queenslanders

A second policy option relates to reforming the tax for senior citizens. According to the 2016 ABS Census data, there are 717,941 Queenslanders aged 65 or over which accounts for 16.1% of the state’s total population. Stamp duty contributes greatly to many senior citizens in Queensland opting to remain in the family home instead of relocating to alternative accommodation that may be better suited to their needs.

Analysis commissioned by the Treasury Department in 2017 stated that with the right incentives in place, as many as 50,000 properties currently occupied by senior Australians could be freed up for younger buyers10. The removal of this costly tax would provide the state’s seniors with the option of being able to move into a home that is easier for them to maintain, while also freeing up housing for up-sizing families in property that allows them to support a growing family.

The Government’s Queensland Housing Strategy 2017-2027 forecasts that roughly 380,000 additional homes will be required over the next 10 years as the state’s population swells to 5.7 million11. A reform to stamp duty that encourages Queensland seniors to purchase smaller homes more conducive to their needs – and in the process freeing homes capable of housing young families – would go a long way to addressing the housing issue confronting Queensland as its population grows over the next decade.

It is the REIQ’s view that an exemption on stamp duty for people aged 65 years and over would have the following positive effects:

- release housing stock to young families looking to up-size into the middle-tier of the market;

- result in prices stabilising in markets where demand is putting upward pressure on limited listings; and

- enable Queensland seniors to live in a house more conducive to their lifestyle needs.

Option 3 - Exemptions for business sales

A final policy option the REIQ proposes is to exempt stamp duty on all business sales. If purchasing a business in Queensland, under the Duties Act 2001 (Qld) stamp duty is generally payable. In the same way it does in the property market, it is arguable that stamp duty acts as a disincentive for acquiring a business.

According to the ABS, the number of new business entries for the year ended 30 June 2015 was 54,550, compared with the 58,155 new businesses that entered the Queensland economy in the year ended 201212. If Queensland wants to encourage new businesses to enter the market and increase growth, then the removal of stamp duty would assist in achieving this aim.

An exemption on stamp duty for all business sales would achieve the following:

- encourage increased transactions in business sales;

- promote growth in the Queensland economy; and

- when an individual does purchase a business, an exemption would provide them with tax relief which in turn could be used to invest in the business or to hire more staff.

Summary

The REIQ has produced three options for meeting the urgent need to reform stamp duty. As outlined above, there are countless studies and research papers that have concluded that it is nothing more than an inefficient and regressive tax that stymies economic activity in the real estate sector. We understand that stamp duty is a tax that accounts for a large degree of revenue for the Queensland state government, however, that revenue stream is also highly volatile and poses a significant burden on the ability of government to plan expenditure into the future.

In its current form, stamp duty in Queensland acts as a handbrake on both property and business transactions and acts as a roadblock to senior citizens moving into a more suitable home. A reform to stamp duty would make housing more affordable and accessible, would stimulate economic growth and provide a significant savings measure for everyday Queenslanders.

1) http://bettertax.gov.au/files/2015/03/TWP_combined-online.pdf

2) https://www2.deloitte.com/au/en/pages/economics/articles/economic-impact-stamp-duty-reform-options.html

3) http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.309.3123&rep=rep1&type=pdf

4) https://www2.deloitte.com/au/en/pages/economics/articles/economic-impact-stamp-duty-reform-options.html

5) https://static.treasury.gov.au/uploads/sites/1/2017/06/Vic_RogerBrake.pdf

6) https://taxreview.treasury.gov.au/content/downloads/final_report_part_2/AFTS_Final_Report_Part_2_Vol_1_Consolidated.pdf

7) http://www.pc.gov.au/inquiries/completed/productivity-review/report/productivity-review.pdf

8) http://bettertax.gov.au/files/2015/03/TWP_combined-online.pdf

9) https://grattan.edu.au/report/property-taxes/

10) http://www.skynews.com.au/news/top-stories/2017/03/11/govt-to-encourage-elderly-to-downsize-homes.html

11) http://www.hpw.qld.gov.au/housingstrategy/Documents/QldHousingStrategy.pdf

12) http://stat.abs.gov.au/itt/r.jsp?RegionSummary®ion=3&dataset=ABS_REGIONAL_ASGS&geoconcept=REGION&measure=MEASURE&datasetASGS=ABS_REGIONAL_ASGS&datasetLGA=ABS_REGIONAL_LGA®ionLGA=REGION®ionASGS=REGION

You may also like

View All Articles

View All Articles

Start your Real Estate Career

Need help? 1300 697 347 or contact us