- 17 Jun 2020

- 9 min read

- By James Hawes

Rentvesting: What is it? And how does it work?

Rentvesting in Queensland. It seems everyone's talking about it. So, earlier in the week I caught up with Ayda Shabanz, Managing Director at Grow Property Group, about a growing real estate trend. And it's called rentvesting. To check out our recorded chat, simply scroll to the bottom of this article to watch.

Our conversation was an access all areas discovery about rentvesting in Queensland: What it is, how it works and why it's popular. What I didn't realise is that it's a strategy option available to everyone. The only difference is it has your specific goals and situation dictating exactly what the model looks like. Put simply, it's not a one-size-fits-all approach to property - in other words, it's custom to you.

"Have one house, pay for 30 years, you own it, or buy two investment properties over 10 years, and let's say in the next 15 years one booms, you could sell one and pay the debt off the other and own it, or sell both, have a really big deposit and buy your dream home," Shabanz explains. "It gives you more options with the same (or less) weekly cash output, but it's still extremely important to get the right property."

The prospect is intriguing and our discussion left me wondering just how beneficial rentvesting in Queensland can be. Cue the number crunching. To set the scenario, let's assume I'm a first home buyer and my goal is to live within the Brisbane LGA. I want to assess three options: buying (owner-occupied), renting and rentvesting. Just a heads up, there are multiple layers of hypotheticals ahead.

Owner-Occupier in Queensland

Brisbane's median house price is $703,000 (as of December 2019 quarter), so if I'm aiming for a 20% deposit, I'd first need to save $140,600. That leaves me with a home loan of $562,400. With the current average interest rate in Australia sitting at 4.44% p.a., let's assume I take out a loan on a 25-year term. This leaves me with a total loan repayment of $932,064 and monthly repayments of $3,107.

All up, I'll end up with a bill totalling $1,068,087, as long as I can live rent-free while saving up that initial deposit (thanks mum and dad!). It's worth remembering since I'm a first home buyer, $15,000 of that initial deposit will be covered by the Queensland First Home Owner's Grant. That is, if only I'm buying a brand new home. Unfortunately, since I'm buying in the inner Brisbane region, it isn't likely I'll be able to snatch a new build.

Tenant in Queensland

Renting that same home would have a maximum upfront cost (bond) of $1,800, followed by further monthly costs of $1,800. Now factor in a rental increase of 7% every five years (extrapolated from the past five years). That means the total rent I'll pay over the next 25 years will be roughly $622,880.

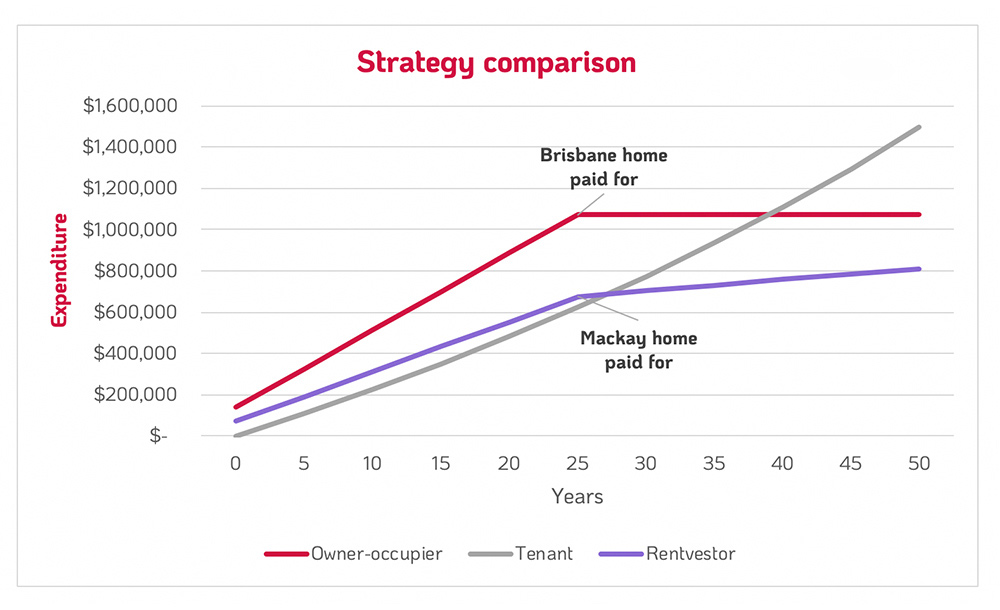

Of course, this is substantially less than if I were an owner-occupier. The major difference is that at the end of that 25 years, I don't own said property. This means over the 25 years that follow, I'll be paying an additional $933,308. This again assumes the same steady increase in median rent. Over those 50 years, that's a sum of $1,555,148.

Even taking into account the unlikeliness of rent increasing at such a steady rate, the disparity is still significant. That is, enough to show that while renting is far cheaper in the short-term, it's dramatically more expensive in the long term. On top of that, it has the added disadvantage of not rewarding me, as a renter, with a valuable asset. So, if renting wins in the short-term and owner-occupying wins in the long-term, is rentvesting the solution that offers the best of both worlds? Let's find out.

Rentvesting in Queensland

Following the traditional model of rentvesting, wherein one purchases a property strictly as an investment and then rents the home they actually want to live in, I'll purchase property in one of Queensland's fastest growing cities: Mackay. Over the last year, Mackay's median house price rose by 2.9% to $350,000. That's the house I'll buy.

I'll gather my 20% deposit - in this case $70,000. Take out a 25-year loan for the remaining $280,000 at 4.44% p.a. My remaining debt totals $464,044, paid off in monthly chunks of $1,547. With the deposit, that's a total expenditure of $534,044.

Meanwhile, the median rent in Mackay is $370 per week or $1,480 per month. I then factor in an average property management fee of around 9%. This brings the amount of rent I can put towards paying off my home loan is $1,347. This leaves me $200 short of my monthly repayments. I then need to account for rental increases. Between December 2018 and December 2019, Mackay's median rent grew a dramatic 8.8%. As much as I'd like that to continue, it's unlikely to maintain such an upward swing. So, for the sake of balance, let's assume Mackay's future growth is the same as Brisbane's (a generous concession, given Mackay's recent growth).

Since Brisbane's starting rate is higher, its monthly rent will increase faster than Mackay's. However, once Mackay's median monthly rent eclipses my loan repayments of $1,547 (which, following a 7% increase every five years, will occur in 2029), the excess can be put towards the rent I'm paying. The total rent received in that time will be $481,760.

Following the Brisbane rental model from earlier, that will see me pay $1,800 a month initially and accrue an expenditure of $622,880 over the 25 years it takes me to pay off my home loan in Mackay. So, over the next quarter of a century, my net expenditure will be $675,219 after which my Mackay investment is paid off. But let's assume I continue with the same scheme. My next 25 years will cost me a further $933,308 in Brisbane rent, which will be offset by receiving another $734,478 in rent from my Mackay property, leaving me down $198,830. Taken over the full half-century then, my total expenditure is $811,843.

While there are other fees associated with owning an investment property, such as covering maintenance, this will mostly be offset by the fact that I won't have to cover the maintenance of the property I'm living in. Therefore it isn't factored into these estimates.

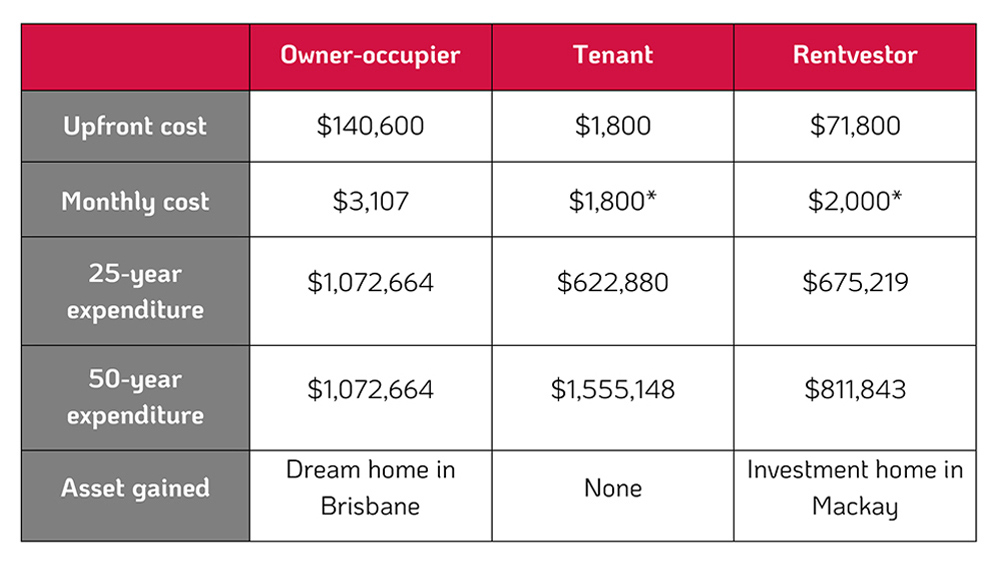

The Scorecard

*The monthly cost will change as rents fluctuate

Please note that these costs are exclusively referring to bonds, rents, deposits and loan payments. It does not include associated costs such as stamp duty, CGT, maintenance, renovations, et al.

As an owner-occupier, I'll have the most significant upfront and monthly costs, but after 25 years I won't have to pay another cent. It's the best long-term solution, but only if it's financially accessible. As a tenant, I'll have a much smaller upfront cost in the form of a bond, which I'll (hopefully) get back when I leave the property.

I also have the smallest monthly expenditure, though it's not significantly less than the rentvester. After 10 years, the rentvester's monthly costs become less than that of the tenant's, too. Without much in the way of upfront cash, this is the most viable option, but I'll suffer if I stay with this strategy in the long-term, ultimately racking up a 50-year expenditure of $1,555,148.

As a rentvester, my initial costs are roughly half of that of the owner-occupier's, but still substantially more than the tenant. My monthly costs start at a touch higher than the tenant's, but over $1,000 less than the owner-occupier's.

After 10 years I'll have the cheapest monthly costs of any plan. After 25 years I'll have spent just $50,000 more than the tenant, almost $400,000 less than the owner-occupier and still have accumulated an asset. The only problem is it's not the asset I want to live in. After the next 25 years, I'll have paid a total of $811,843, which is still less than the owner-occupier, but I still don't own my dream home and all this extra money isn't going towards an asset anymore.

Final Thoughts

Firstly, it needs to be reiterated that the above figures are gathered by extrapolating past and present data. They don't represent future prospects based on fundamentals, market conditions and other indicators. This is also a tiny sample of the virtually infinite options available to those looking to enter the property market. In particular, because it solely looks at median prices and rents.

As always, before making any financial decision, it's imperative you weigh up all options and possibilities before committing to anything. The case studies offered are baseline controls. They don't represent the near-infinite permutations and directions one might take in their property journey. The tenant may have saved enough for a deposit after 5 years.

The rentvester may immediately sell their property once it's paid off after 25 years. The owner-occupier could choose to purchase a cheaper home to later use as equity against the loan for their dream home. Other factors to be considered are economic and market fluctuations, various dwelling types, tax considerations such as CGT and negative gearing, and so the list goes on.

Ultimately, property has never been a one-size-fits-all market, and rentvesting in Queensland doesn't break that status quo. It's simply a strategy that could work for some while it wouldn't work for others. It's always best to do your research and find a strategy that suits your property goals and financial situation.

Important disclaimer: This article is provided for general information only, and the author is not engaged to render professional financial advice or services through this article. Readers should satisfy themselves as to the correctness, relevance, and applicability of any of the above content, and should not act on any of it in respect of any specific purchase, investment, or other financial activity without first obtaining their own independent professional financial advice.

You may also like

View All Articles

View All Articles

Start your Real Estate Career

Need help? 1300 697 347 or contact us