- 21 Aug 2020

- 4 min read

- By Eliza Owen, Head of Research at CoreLogic

Queensland housing market summary : June 2020 Quarter

The COVID-19 pandemic has interrupted positive growth momentum across Queensland dwelling markets, but the decline in housing values has been relatively mild to date.

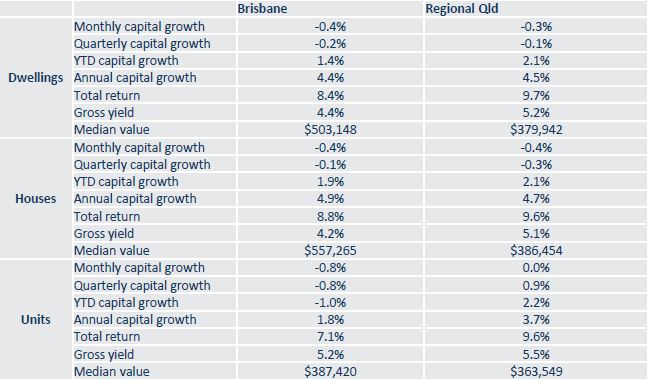

In the June quarter, the Brisbane dwelling market declined just -0.2%. Interestingly, this fall was driven by the Brisbane -Inner City region, where values fell -2.4%. No other SA4 market recorded a value fall in the quarter.

The weakness in the Brisbane - Inner City market is likely tied to poor performance in investment housing. In the June quarter, rental stock across the Brisbane - Inner City region increased 12.1%, contributing to a -1.5% decline in rent values.

Meanwhile, the quarter saw robust performance across the Brisbane - East market, where values rose 1.9%. Low interest rates, deeper vendor discounts and a relatively low price point may be supporting first home buyer demand in this region, which could be attributed to value increases.

Prior to the onset of COVID-19, there were several factors pointing to positive growth across Queensland dwelling markets, particularly south-east Queensland. Dwelling completions across the state had moderated to 8,805 in the March 2020 quarter, trending down from a peak of 12,241 over March 2017.

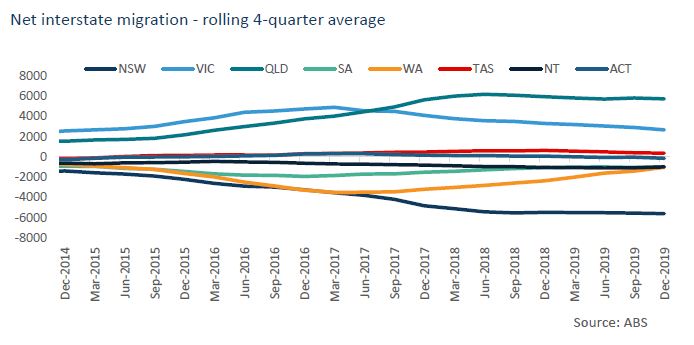

As the supply of dwellings across the state had moderated, the rate of population growth was positive, but slowed from 1.8% in 2018 to 1.6% over 2019. However, Queensland has had the highest volume of net interstate migration since September 2017.

Granular migration data shows that in the year to June 2019, the highest level of departure by region for net interstate migration to Queensland were the ACT (8,539), Darwin (1,247) and Richmond-Tweed (1,192). The highest volumes of net interstate migration by arrival in Queensland were the Gold Coast (7,918), the Sunshine Coast (4,577) and Ipswich (2,874).

These migration patterns speak to a particular strength in demand across south-east Queensland, because it is evidence of a desire to migrate to the region, even before the onset of the pandemic had normalised remote work arrangements for professional and clerical work. This structural change to housing demand may amplify relocation to south-east Queensland in the long term.

Holiday markets tested by border closures

In the short term, growth in dwelling values across the region will continue to be disrupted following the strengthened border restrictions for people travelling from NSW, the ACT and Victoria in July and August.The border closures coincide, and in some cases may relate to, a disruption to the recovery in payroll jobs numbers. The Gold Coast has seen the largest decline in payroll jobs of Queensland regions between the 14thof March and the 11thof July. Payroll jobs numbers across the Gold Coast were down 7.1%. This is perhaps unsurprising given that prior to the pandemic, 10.6% of the workforce was employed across accommodation and food services.

Job losses in this sector, combined with vacant holiday dwellings, are putting downward pressure on rents in the region. Rent values across the Gold Coast fell 0.2% in the June quarter.

The Sunshine Coast and Gold Coast dwelling markets still saw dwelling price increases in the June quarter, of 1.0% and 0.7% respectively. However, these increases are modest and signify a deceleration of growth in these markets. The Sunshine Coast and Gold Coast dwelling market performance will be closely tied to the state of interstate and overseas migration, as well as opportunities for holiday travel.

As borders are likely to stay closed until 2021, these markets may see mild price falls before next year. Like most markets across Australia, a return to upswing for many Queensland markets depend upon getting ahead of the COVID-19 curve, the easing of social distancing measures and the re-opening of domestic and international borders. Unlike parts of the country, many parts of Queensland, including coastal regional areas and South East Queensland, present affordably priced housing options and an appealing lifestyle.

This Queensland Housing Market article has been published with permission from CoreLogic. To read the full Quarterly Economic Review - The Australian Residential Property Market and Economy (June Quarter 2020), click here.

The REIQ produces the Queensland Market Monitor (QMM) on a quarterly basis - an electronic publication entirely focused on the residential sales and rental markets of the Sunshine State. Whether you're in the real estate profession, an astute investor or a potential home buyer. The QMM is available to REIQ Members free of charge, and to general public subscribers at the following costs: Single Issue $25, 4 Issues (1 year) $85, 8 Issues (2 years) $160. To learn more or to subscribe, click here.

You might also like

View All Articles

View All Articles

Start your Real Estate Career

Need help? 1300 697 347 or contact us