- 09 Dec 2019

- 5 min read

- By Nicole Madigan

The rise of renters and what that means for property management

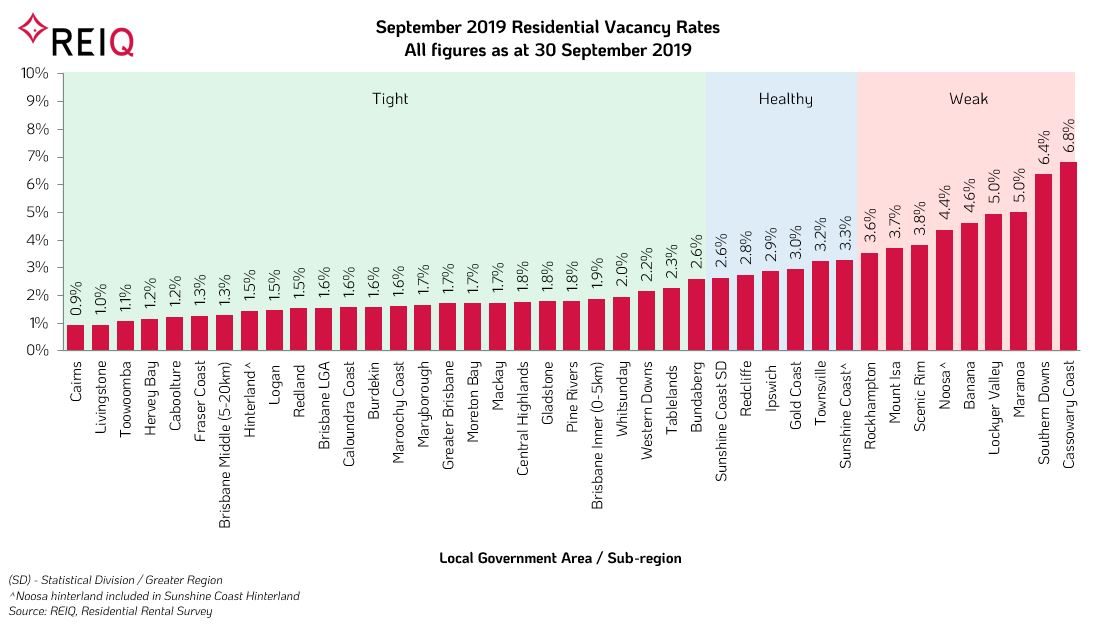

More than half of Queensland's local government areas recorded tight vacancy rates during the September quarter, with only a handful reporting healthy or weak rates, the REIQ's Rental Vacancy Report has revealed.

Brisbane's rental market re-entered the tight range for the first time in three quarters, recording its lowest vacancy rate in 11 years, at 1.6 per cent, as the market tightened by 1.2 per cent from the June quarter.

The Greater Brisbane market also reported its lowest vacancy rate in over a decade at 1.7 per cent, 0.7 per cent lower than previous quarter and 0.5 per cent lower than the same quarter in 2018.

Outside of Brisbane, Cairns vacancies reached an historical record low for the region, reporting 0.9 per cent for the quarter.

It was a similar story across the board, with Queensland's overall vacancy rates moving marginally from 2.4 per cent in the June quarter to 2.2 per cent for the September quarter, resulting in a tighter position overall.

These figures, combined with new data showing a decline in homeownership across all demographics, suggests the number of renters is on the rise.

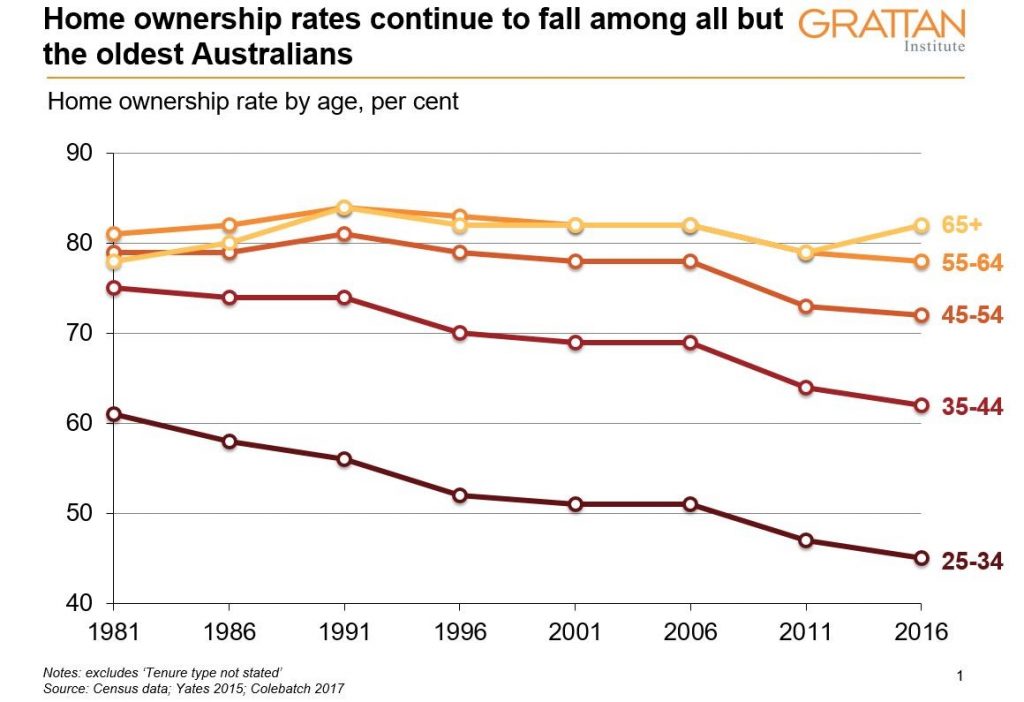

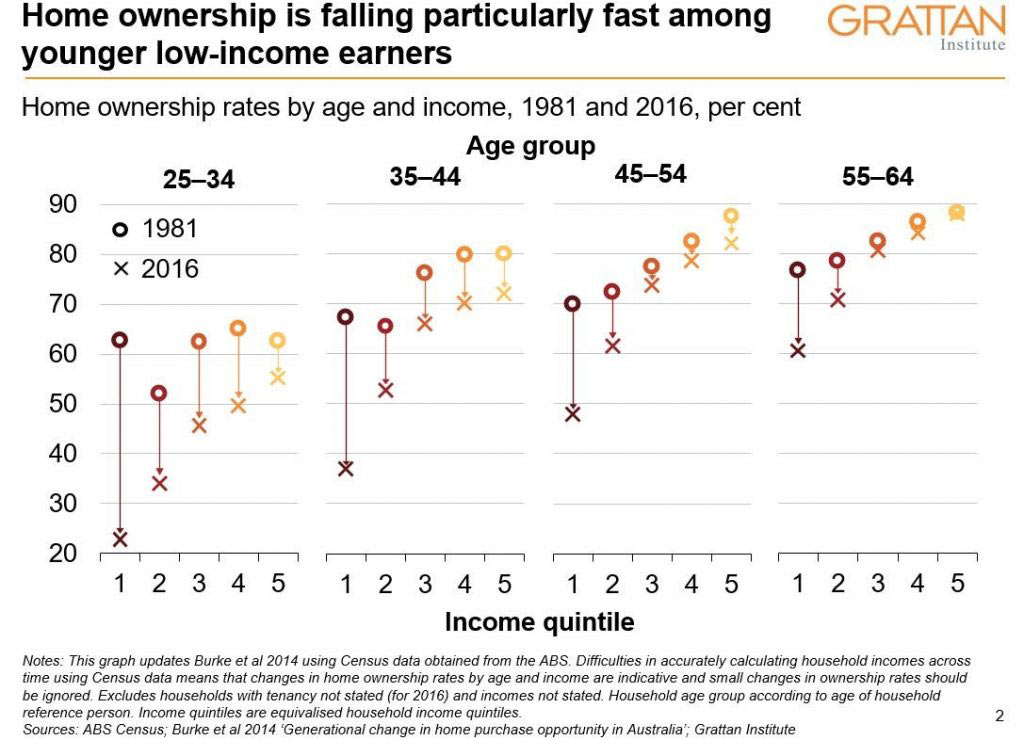

The research, from the Grattan Institute, shows that home ownership rates are continuing to fall among all but the oldest Australians, and particularly quickly among young, low-income earners.

While the reasons for homeownership decline are varied, no doubt a portion of those once would-be buyers, are instead, renters, meaning increasing opportunities for investors hoping to capitlise on a growing pool of potential tenants.

The flow on impact of this, then, is on property management businesses, real estate agencies with rent rolls, and of course, property managers themselves.

Which begs the question, will agencies need a rent roll in order to be profitable in the future?

Real estate focused Performance Growth Coach and Business Strategist, Peter Sissons, says while it's not essential for profitability, having multiple sources of income is always a good thing, especially when an income source can be easily expanded.

"A rent roll is not only an additional source of income, but also a saleable asset which can be built up organically at little cost during the life time of an agency and leveraged against when required," says Mr Sissons.

"It also provides a great way to maintain relationships with the agency's investor clients which can, if nurtured properly, lead to significantly more business in the future."

Today, more than ever, agencies are beginning to understand the need to build and maintain property management services.

The challenge today, says Sissons, is competing with the disruptors and apps that suggest they can offer property management at a reduced cost to the investor.

"We are now in a world that understands relationships are the currency of the future, and maintaining a close and professional relationship with investors/property owners assures an agency of business in the future."

One of the major benefits of owning a rent roll is the guaranteed monthly revenue it provides, and with the rapid increase in renters coming into the market, it's a revenue base that can be increased rapidly overtime.

The changing role of the property manager

As the need and desire for property management services within real estate agencies grows with the number of potential tenants, so too does the value of the property manager role.

"Unfortunately, property management was for decades viewed as the poor cousin in many smaller businesses.

"This has certainly changed over recent times, with everyone becoming more aware that the rent roll is actually an 'investment management' service, taking care of millions of dollars' worth of assets.

This, coupled with the ever growing level of compliance and demand for such services, makes the property manager's role far more specialised.

"An experienced property manager has to wear many hats and be able to operate effectively under pressure.

"They need to have an acute level of empathy, while also maintaining detailed records for compliance purposes.

"They have to be able to negotiate and communicate with both investors and tenants effectively - it's a very challenging role."

As demand for high quality property managers grows, larger agencies are now often using psychological profiling tests in an attempt to ensure the people they are placing into such important roles have the right aptitude.

"There is also a growing retention trend for senior property managers to be granted the opportunity of buying into or acquiring a shareholding in the actual company that owns the rent roll."

The future of property management

As rental demand continues to rise, the focus on property management and property management must increase in kind.

"As an industry we need to be aware of the high level of burn out sustained within the property management side of our business," says Mr Sissons.

"Designing effective business units where workloads and responsibilities are shared is the only way forward.

"With new technology and the ever changing level of legal and financial compliance, ongoing training and education in this part of the real estate business will be essential."

For more information like this, click here.

For more information like this, click here.

You might also like

View All Articles

View All Articles

Start your Real Estate Career

Need help? 1300 697 347 or contact us